• 在各界热议其庞大现金储备用途之际,沃伦·巴菲特执掌的伯克希尔哈撒韦公司(Berkshire Hathaway)现金储备规模持续攀升。但在致集团股东的年度信中,这位投资巨擘重申了投资企业股票而非囤积现金的意愿。

尽管现金储备持续攀升,但伯克希尔哈撒韦董事长兼首席执行官沃伦·巴菲特周六重申了投资承诺。

截至第四季度末,伯克希尔哈撒韦现金储备达3,342亿美元,较一年前的1,676亿美元近乎翻番。这一增长源于巴菲特过去八个季度持续净卖出操作,减持了苹果(Apple)、美国银行(Bank of America)与花旗集团(Citigroup)等公司的股票。目前公司股票投资组合规模已从一年前的3,540亿美元缩减至2,720亿美元。

与此同时,伯克希尔哈撒韦旗下仍拥有Geico保险公司、伯灵顿北方圣达菲铁路公司(BNSF)、Dairy Queen、喜诗糖果(See’s Candy)等子公司的股权。但近年来市场估值高企,令这位以价值投资著称的“奥马哈先知”望而却步,已许久未动用现金进行重大收购交易。

巴菲特在年度股东信中写道:“尽管某些评论认为伯克希尔哈撒韦当前现金头寸非同寻常,但公司绝大部分资金仍配置于股票资产,这一偏好不会改变。”

在此封年度信发布前,市场对94岁高龄的巴菲特持续囤积现金的原因猜测不断。

近25年前互联网泡沫破裂前夕,巴菲特曾以类似今日伯克希尔哈撒韦的操作置身事外,拒绝投资高估值科技股,并任由现金储备膨胀。

在周六发布的信中,巴菲特未对当前市场前景做出预测,但强调伯克希尔哈撒韦投资立场始终如一。

他写道:“伯克希尔哈撒韦的股东可以放心,我们永远会将他们的大部分资金配置于股票资产——主要是美国公司的股票,尽管其中许多公司有重要的国际业务。无论控股还是参股,伯克希尔哈撒韦永远不会认为持有类现金资产优于持有优质企业股权。”

巴菲特同时表示公司暂无派息计划,并指出现金的安全性并不可靠,其价值“可能转瞬即逝”。

巴菲特表示:“固定收益债券无法抵御货币失控贬值风险。”

巴菲特将企业经营比作追逐目标的人,强调只要对商品与服务存在需求,企业“通常能找到应对货币不稳定的方法”。

他表示:“个人才能亦是如此。由于缺乏运动天赋、美妙歌喉、医学法律技能等特殊才能,我毕生不得不仰仗股票投资。本质上,我的成功依赖于美国企业的成功,未来仍将如此。”(财富中文网)

译者:刘进龙

审校:汪皓

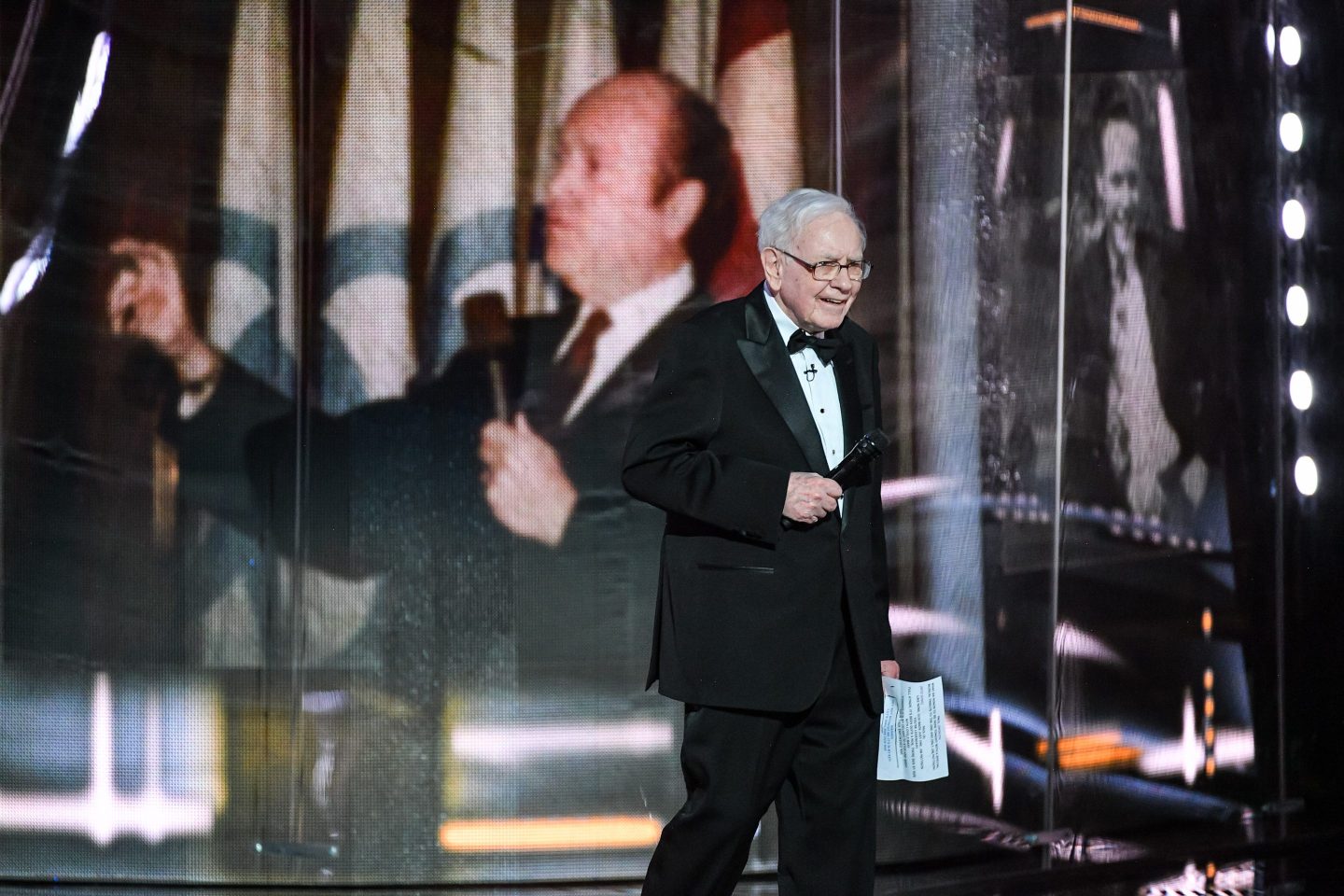

伯克希尔哈撒韦首席执行官兼董事长沃伦·巴菲特,拍摄于2018年。George Pimentel—Getty Images

• 在各界热议其庞大现金储备用途之际,沃伦·巴菲特执掌的伯克希尔哈撒韦公司(Berkshire Hathaway)现金储备规模持续攀升。但在致集团股东的年度信中,这位投资巨擘重申了投资企业股票而非囤积现金的意愿。

尽管现金储备持续攀升,但伯克希尔哈撒韦董事长兼首席执行官沃伦·巴菲特周六重申了投资承诺。

截至第四季度末,伯克希尔哈撒韦现金储备达3,342亿美元,较一年前的1,676亿美元近乎翻番。这一增长源于巴菲特过去八个季度持续净卖出操作,减持了苹果(Apple)、美国银行(Bank of America)与花旗集团(Citigroup)等公司的股票。目前公司股票投资组合规模已从一年前的3,540亿美元缩减至2,720亿美元。

与此同时,伯克希尔哈撒韦旗下仍拥有Geico保险公司、伯灵顿北方圣达菲铁路公司(BNSF)、Dairy Queen、喜诗糖果(See’s Candy)等子公司的股权。但近年来市场估值高企,令这位以价值投资著称的“奥马哈先知”望而却步,已许久未动用现金进行重大收购交易。

巴菲特在年度股东信中写道:“尽管某些评论认为伯克希尔哈撒韦当前现金头寸非同寻常,但公司绝大部分资金仍配置于股票资产,这一偏好不会改变。”

在此封年度信发布前,市场对94岁高龄的巴菲特持续囤积现金的原因猜测不断。

近25年前互联网泡沫破裂前夕,巴菲特曾以类似今日伯克希尔哈撒韦的操作置身事外,拒绝投资高估值科技股,并任由现金储备膨胀。

在周六发布的信中,巴菲特未对当前市场前景做出预测,但强调伯克希尔哈撒韦投资立场始终如一。

他写道:“伯克希尔哈撒韦的股东可以放心,我们永远会将他们的大部分资金配置于股票资产——主要是美国公司的股票,尽管其中许多公司有重要的国际业务。无论控股还是参股,伯克希尔哈撒韦永远不会认为持有类现金资产优于持有优质企业股权。”

巴菲特同时表示公司暂无派息计划,并指出现金的安全性并不可靠,其价值“可能转瞬即逝”。

巴菲特表示:“固定收益债券无法抵御货币失控贬值风险。”

巴菲特将企业经营比作追逐目标的人,强调只要对商品与服务存在需求,企业“通常能找到应对货币不稳定的方法”。

他表示:“个人才能亦是如此。由于缺乏运动天赋、美妙歌喉、医学法律技能等特殊才能,我毕生不得不仰仗股票投资。本质上,我的成功依赖于美国企业的成功,未来仍将如此。”(财富中文网)

译者:刘进龙

审校:汪皓

Berkshire Hathaway CEO and chairman Warren Buffett in 2018.

• Warren Buffett’s Berkshire Hathaway saw its stockpile of cash continue to swell, amid questions about what he plans to do with all that money. But in his annual letter to the conglomerate’s shareholders, he reaffirmed his desire to invest in businesses, rather than hold onto cash.

Berkshire Hathaway Chairman and CEO Warren Buffett reaffirmed his commitment to investing Saturday, even as his conglomerate continued accumulating cash reserves.

Berkshire’s cash pile hit $334.2 billion at the end of the fourth quarter, nearly double from $167.6 billion a year ago. That’s after Buffett has been a net seller over the last eight quarters, trimming his stakes in Apple, Bank of America, and Citigroup. The size of Berkshire’s stock portfolio has shrunk to $272 billion from $354 billion a year ago.

Meanwhile, Berkshire’s other equity holdings include subsidiaries like Geico, BNSF, Dairy Queen, and See’s Candy. But Buffett hasn’t used its cash in a major takeover deal in a while as the famously value-conscious investor has balked at high valuations in recent years.

“Despite what some commentators currently view as an extraordinary cash position at Berkshire, the great majority of your money remains in equities,” Buffett wrote in his annual letter to shareholders. “That preference won’t change.”

Anticipation rose leading up to the latest letter, as investors speculated why the 94-year-old “Oracle of Omaha” had been stacking up cash reserves.

Prior to the dotcom bubble burst nearly 25 years ago, Buffett famously stayed on the sidelines instead of investing in high-flying tech stocks and let his cash pile grow, similar to what’s seen with Berkshire today.

On Saturday, he refrained from offering a prediction about the current market landscape but vowed that Berkshire’s investing stance hasn’t changed.

“Berkshire shareholders can rest assured that we will forever deploy a substantial majority of their money in equities — mostly American equities although many of these will have international operations of significance,” Buffett wrote. “Berkshire will never prefer ownership of cash-equivalent assets over the ownership of good business, whether controlled or only partially owned.”

He added that Berkshire doesn’t have plans to offer a dividend, while noting that the security of cash is uncertain and “can see its value evaporate.”

“Fixed bonds provide no protection against runaway currency,” Buffett said.

Buffett said businesses are like people with goals they want to pursue, adding that they “will usually find a way to cope with monetary instability,” if there is a demand for goods and services.

“So, too, with personal skills,” he said. “Lacking such assets as athletic excellence, a wonderful voice, medical or legal skills or, for that matter, any special talents, I have had to rely on equities throughout my life. In effect, I have depended on the success of American businesses and I will continue to do so.”