在美国金融史上,诸多声名狼藉的事件所发生的那几周令人刻骨铭心,比如1929年的“黑色星期二”股市崩盘,2008年雷曼兄弟破产,或是2020年新冠疫情引发的冲击。如今,我们可以把唐纳德·特朗普在过去两周内接连宣布的全面关税政策所引发的“解放日”市场崩溃也列入这份“不光彩名单”。

随之造成的损失极为惨重。投资者陷入恐慌,纷纷抛售股票和美国国债,导致4月2日至4月9日总统宣布“暂停”部分关税期间,全球股市市值蒸发了十万亿美元。尽管到周五时,市场已经收复了大部分失地,但多数主要股指仍处于回调区间,并且由于众多交易员担心后续还将面临更为严重的经济损失,市场仍处于动荡状态,行情波动剧烈。

在持续的动荡局势中,事情的来龙去脉以及潜在的长期影响正逐渐变得清晰。诚然,最显而易见的是,关税政策无疑是这场危机的直接诱因,因为近一个世纪以来,美国政府首次背离自由市场原则,转而奉行重商主义。除此之外,特朗普以提振美国工业生产为旗号推行关税政策,但其执行过程毫无章法,政策朝令夕改,加剧了市场的不确定性。没人能预测他的下一步行动;白宫和企业领导人之间的沟通渠道近乎堵塞。

资本市场已清晰释放出对当前状况不满的信号。最令人担忧的是,众多投资者选择抛售美国国债——数十年来,美国国债始终被视为最安全的避险资产。在人们的记忆中,首次出现部分投资者对美国金融体系丧失信心,转而在欧洲和亚洲寻求安全保障。

这种信心下滑不仅体现在美国短期国债抛售上,还体现在美元汇率的陡然暴跌上。企业领导人此前大多保持沉默,直到“解放日”事件爆发,如今他们开始对美国经济或将遭受的长期损害发出警告,而企业则在努力应对供应链的混乱,并为未来做规划。与此同时,关税普遍被认定为通货膨胀的推手,消费者的担忧日益加剧,因为他们意识到鸡蛋价格不会下降,而且汽车和许多其他商品即便不至于完全超出购买力,价格也可能迅速攀升至令人望而却步的地步。

在这种前所未有的经济形势下,企业高管和投资者应该如何应对呢?为了提供一些指导,《财富》杂志借助了资深商业记者的专业洞见,既展开深刻剖析,例如概述了致使特朗普在最新一轮关税举措上有所退缩的债券市场“风波”,还给出了切实可行的建议。我们精心挑选了近期的优质报道,将其汇总于特别报道《危机中的经济》之中。

我们的指南涵盖了对黄金、比特币等热门资产表现情况的分析,并就如何调整投资组合以应对美元贬值及其他可能永久性重塑金融格局的因素给出了建议。我们还报道了沃尔玛、苹果等《财富》世界500强企业如何适应跨境贸易自由化不再被视为理所当然的环境。这些报道共同阐释了过去十年间市场最动荡的十天里究竟发生了什么,并对这场似乎远未结束的经济风暴未来走向提供了一些见解。(财富中文网)

译者:中慧言-王芳

在美国金融史上,诸多声名狼藉的事件所发生的那几周令人刻骨铭心,比如1929年的“黑色星期二”股市崩盘,2008年雷曼兄弟破产,或是2020年新冠疫情引发的冲击。如今,我们可以把唐纳德·特朗普在过去两周内接连宣布的全面关税政策所引发的“解放日”市场崩溃也列入这份“不光彩名单”。

随之造成的损失极为惨重。投资者陷入恐慌,纷纷抛售股票和美国国债,导致4月2日至4月9日总统宣布“暂停”部分关税期间,全球股市市值蒸发了十万亿美元。尽管到周五时,市场已经收复了大部分失地,但多数主要股指仍处于回调区间,并且由于众多交易员担心后续还将面临更为严重的经济损失,市场仍处于动荡状态,行情波动剧烈。

在持续的动荡局势中,事情的来龙去脉以及潜在的长期影响正逐渐变得清晰。诚然,最显而易见的是,关税政策无疑是这场危机的直接诱因,因为近一个世纪以来,美国政府首次背离自由市场原则,转而奉行重商主义。除此之外,特朗普以提振美国工业生产为旗号推行关税政策,但其执行过程毫无章法,政策朝令夕改,加剧了市场的不确定性。没人能预测他的下一步行动;白宫和企业领导人之间的沟通渠道近乎堵塞。

资本市场已清晰释放出对当前状况不满的信号。最令人担忧的是,众多投资者选择抛售美国国债——数十年来,美国国债始终被视为最安全的避险资产。在人们的记忆中,首次出现部分投资者对美国金融体系丧失信心,转而在欧洲和亚洲寻求安全保障。

这种信心下滑不仅体现在美国短期国债抛售上,还体现在美元汇率的陡然暴跌上。企业领导人此前大多保持沉默,直到“解放日”事件爆发,如今他们开始对美国经济或将遭受的长期损害发出警告,而企业则在努力应对供应链的混乱,并为未来做规划。与此同时,关税普遍被认定为通货膨胀的推手,消费者的担忧日益加剧,因为他们意识到鸡蛋价格不会下降,而且汽车和许多其他商品即便不至于完全超出购买力,价格也可能迅速攀升至令人望而却步的地步。

在这种前所未有的经济形势下,企业高管和投资者应该如何应对呢?为了提供一些指导,《财富》杂志借助了资深商业记者的专业洞见,既展开深刻剖析,例如概述了致使特朗普在最新一轮关税举措上有所退缩的债券市场“风波”,还给出了切实可行的建议。我们精心挑选了近期的优质报道,将其汇总于特别报道《危机中的经济》之中。

我们的指南涵盖了对黄金、比特币等热门资产表现情况的分析,并就如何调整投资组合以应对美元贬值及其他可能永久性重塑金融格局的因素给出了建议。我们还报道了沃尔玛、苹果等《财富》世界500强企业如何适应跨境贸易自由化不再被视为理所当然的环境。这些报道共同阐释了过去十年间市场最动荡的十天里究竟发生了什么,并对这场似乎远未结束的经济风暴未来走向提供了一些见解。(财富中文网)

译者:中慧言-王芳

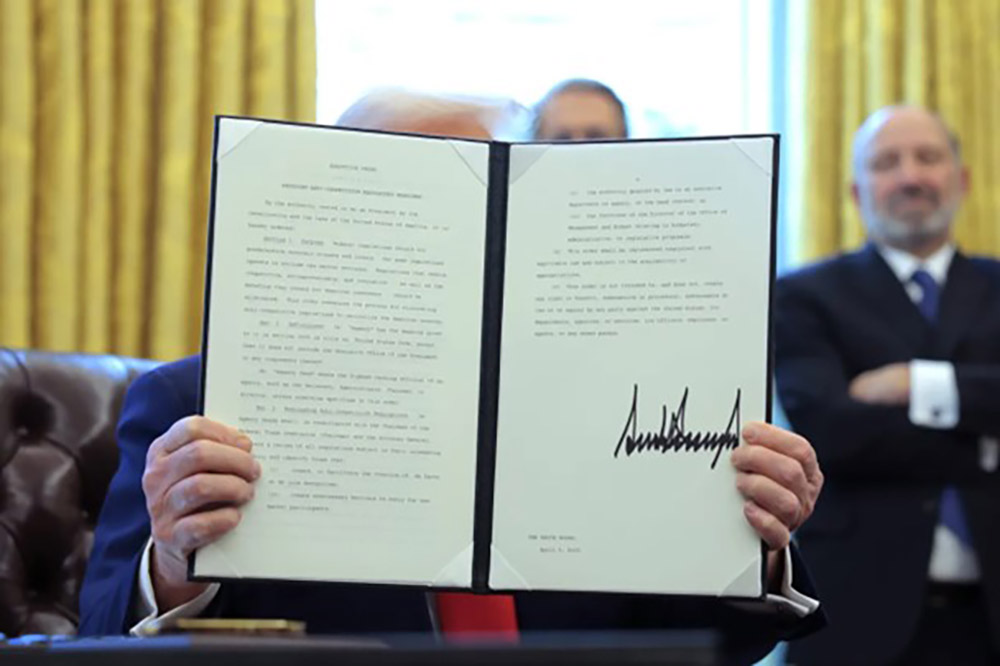

In U.S. financial history, there are weeks that live in infamy—like the “Black Tuesday” stock market crash of 1929, or the 2008 Lehman Brothers bankruptcy, or the COVID-induced shock of 2020. To this list we can add the “Liberation Day” market meltdown triggered by President Donald Trump’s successive announcements of sweeping tariffs over the past two weeks.

The ensuing damage was enormous, as panicked investors sold off both stocks and U.S. Treasuries, leading to a $10 trillion wipeout in global equities between April 2 and April 9, when the president “paused” some of his tariffs. While the markets had recovered much of those losses by Friday, most major stock indexes are still in correction territory, and remain in a state of turmoil defined by wild volatility, as many traders fear there’s far more economic damage to come.

Amid the enduring chaos, a clearer picture is emerging of what happened, and what the potential long-term effects could be. Most obviously, of course, the tariffs themselves have caused the meltdown as, for the first time in nearly a century, the U.S. government has forsaken free markets in favor of mercantilism. On top of this fire, Trump has poured the gasoline of uncertainty, rolling out tariffs in the name of increasing U.S. industrial production, but implementing them in haphazard ways, and then abruptly reversing his decisions. No one knows what he will do next; communication between the White House and business leaders has been scant.

The capital markets have made clear that they don’t like what’s happening. In the most alarming development, many investors have reacted by selling off U.S. Treasury bills—the asset that for decades has represented the safest of safe havens. For the first time in living memory, some players have lost confidence in the U.S. financial system and are seeking security instead in Europe and Asia.

This erosion of confidence is being felt not only in the sell-off of T-bills, but in the sudden plunge of the U.S. dollar. Business leaders, who stayed mostly silent until the Liberation Day fallout, are beginning to sound the alarm about long-term harm to the American economy, while companies are scrambling to address upended supply chains and plan for the future. Tariffs, meanwhile, are widely regarded as inflationary, and consumers are increasingly frightened as they realize that the cost of eggs is not coming down, and that cars and many other goods could soon be punishingly expensive, if not out of their reach altogether.

In these unprecedented economic conditions, how should executives and investors react? To offer some guidance, Fortune has tapped into the expertise of its veteran business journalists to provide both sharp analysis—such as an overview of the “murder mystery” in the bond market that led Trump to flinch on his latest round of tariffs—and practical advice. We’ve curated some of our best recent coverage in a special report, The Economy In Crisis.

Our guidance includes a look at how some popular assets, including gold and Bitcoin, are performing, and advice on how to adjust your portfolio to account for a declining dollar and other potentially permanent shifts in the financial landscape. We report on how Walmart, Apple, and other Fortune 500 companies are adjusting to a climate in which free cross-border trade can no longer be taken for granted. Together, the stories help explain what happened in the most chaotic 10 days in the market in years, and offer a sense of what could happen next in an economic storm that appears far from over. Read on—and buckle up.